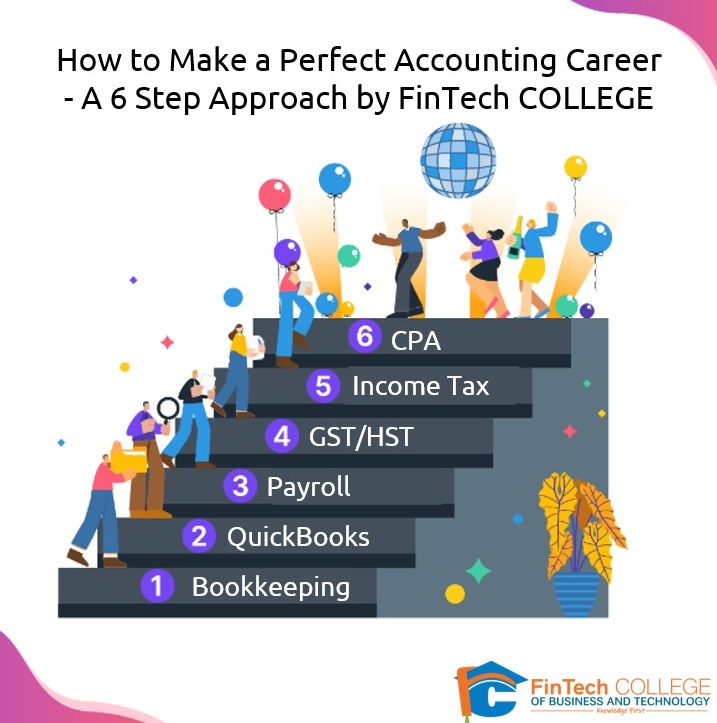

In this blog, I will provide a Career Path on how to make a Perfect Career in Accounting. Doesn’t matter whether you are Starting or are Experienced in the field. If you are planning or unable to take your Career forward, this 6 Step Approach provided will be beneficial for everyone.

-

-

Master Your Bookkeeping

-

Learn an Accounting Software

-

Payroll-An Essential Skill

-

Get a Grip on GST/HST

-

Advance Your Career with Income Tax

-

Build Your Future Skills by Pursuing a CPA

-

Let’s look at the 6 Steps in the path:

1. Master Your Bookkeeping:

- Having a thorough bookkeeping knowledge is the most important starting point for anyone who wants to make their career in the field of Accounting and Bookkeeping.

- If your Bookkeeping concepts are clear your path till Income Tax T2 will be easy and enjoyable to study. Many students they come for Income Tax Study but they do not have clear understanding of Debits and Credits. In that case, they get disappointed in Taxation (especially T2125 and Income Tax T2).

- With clear Bookkeeping understanding of Debits, Credits, Journalizing, General Ledger Posting, Adjusting entries, year end entries, subsidiary books, accounts receivables, accounts payables, discounts and credits, inventory postings your confidence during job interviews will be awesome.

- You can sense it and the opposite interviewer will also be able to sense it. Study Accounting and Bookkeeping courses from a College or Institute by researching their syllabus.

Download Our Bookkeeping: Syllabus

2. Learn an Accounting Software:

- As mostly no one does manual bookkeeping these days, having knowledge of a widely used Accounting Software is mandatory.

- QuickBooks, needless say is the mostly widely used software in small and medium businesses in North America. Knowing a Software is good but mastering a software will give the competitive edge. When you study QuickBooks, focus should be to study hands-on. As when you study hands-on you will get better understanding and an experience, which will be helpful when you use it at your job day-to-day functionalities. There are institutes who just go through the slides, that will not be of much help.

- Also, just knowing the basic functions like how to create a customer or recording a invoice would not suffice a whole lot. You need to know the basic and advanced usage of the software like Bank Reconciliation, Sales Tax, Payroll, Payroll remittances, year end procedures.

- The employers will be looking for someone who can handle all these functionalities for them and when this goes with clear bookkeeping concepts, probably you are the perfect fit for the employers organization.

Download Our QuickBooks Online: Syllabus

3. Payroll-An Essential Skill:

- For any employer one of the biggest tasks if the are having employees is Payroll. There are 2 specific reasons for that:

-

-

- The business is almost interacting with CRA either monthly or quarterly

- It is also generally the top 3 costs in an organization.

-

- The employers are always looking for someone who can do this job efficiently. If they find an employee who can do their payroll as per schedule (weekly, bi-weekly), complete payroll remittances on time and ensure T4 and T4 summary are sent to CRA during year end accurately they probably are going to be very happy. On top of that there can be WSIB, EHT and several other remittances for the business.

- Imagine an individual with Bookkeeping, QuickBooks and Payroll knowledge and if possible, in detail they certainly will be the top priority for an employer.

Download Our Payroll Administrator: Syllabus

4. Get a Grip on GST/HST:

Needles to say, Sales Tax, is a crucial portion of any Bookkeeping and business. Calculating HST collected, ensuring correct input tax credits are claimed and remitting sales tax on time to CRA will be responsibility of someone in the organization.

Just like Payroll, in GST/HST the frequency of interaction with CRA could be higher (monthly, quarterly). It could be instalment payments or filing. The employer will look for someone who is knowledgeable with Sales Tax procedures. Learning Sales Tax will get you one more step clear in the taxation world of Canadian economy.

After acquiring the top four skills you should be ready to go for job hunting and get probably more than one employer ready to hire you! From here you can starting taking your career further.

Download Our GST/HST: Syllabus

5. Advance Your Career with Income Tax:

- I have seen students are really interested in studying taxation and they want to study all the tax courses Income Tax T1, T2125, T2, GST/HST.

- There are specifically 2 categories of students:

-

-

- Who are new to Canada and they want to learn Canadian Taxation

- Those who are looking to start their own Bookkeeping and Taxation practice

-

- It is important when you study taxation you want to make sure you study hands-on and you want to do it by yourself. Whichever institute or college you study from have a look at their syllabus.

- There are institutes who teach just the basic for 2-3 years. Taxation is not Rocket science. And someone who has -bookkeeping knowledge can learn taxation in less than 4 weeks. Once you have learnt, taxation and start doing tax filing in real world, there will be numerous scenarios from which your journey of learning will continue.

- Taxation is an ever-changing world, unlike Bookkeeping. If you want to learn taxation you want to start with Income Tax T1, many time students think they know taxation but actually they know only basics how to fill a T4, T5, some are little advance like rental income and that is it.

- Actually, Income Tax T1 is way more than that, it is learning about Employment Income, Investment Income, Rental Income, Business or Professional Income, Deductions, Credits, Provincial taxes & Credits and each of these have numerous topics like Capital Gains tax, Principal residence exemption, dividends tax, CCA calculations, T2125 calculations, leasing costs, motor vehicle costs and other T-slips and schedules.

- Next, if your bookkeeping concept are clear you want to master T2 or corporation taxes.

Download Our Income TAX T1: Syllabus

Download Our Income TAX T1 – Advanced: Syllabus

Download Our Income TAX T2: Syllabus

6. Build Your Future Skills by Pursuing a CPA:

- With the experience and knowledge that you have acquired you probably are ready to take a big jump in your career and looking to being a CPA.

- You probably are going to be a strategic advisor or a professional but remember all of your above skills that you have acquired is going to build you for that. That is your foundation. The stronger the foundation the further you go.

- Even those who are not CPA’s at times they are more knowledgeable and that is because of their experience and different industry scenarios they have been a part of.

Conclusion:

Doesn’t matter if you are a newbie or having experience, Bookkeeping is a great field and if you have Taxation skills along with that, there is no doubt you can have a glorious career. The most important area you want to focus is to fill the gaps in your knowledge. Whether you have studied Bookkeeping or not our courses are full of hands-on exercises, study material and are always instructor led which gives you support, which you need one in your study. We encourage you to read our reviews by our alumni students and join our FREE WORKSHOPS. We welcome you to start your journey of learning with us. Talk to a student success advisor, today!

Check our link for more details https://www.fintechcollege.ca/toronto/

When I originally commented I appear to have clicked the -Notify me when new comments are added- checkbox and from now on every time a comment is added I receive four emails with the same comment. There has to be a way you can remove me from that service? Many thanks!