Your education is an investment in yourself and your future.

Do you need financial support to pay for the costs of your career courses from FinTech College? Our partner, Windmill Microlending, can help you.

Windmill Microlending is a Canadian charity offering affordable loans to immigrants and refugees to help them pay for the costs of education, training, accreditation, certification, designation, language and professional development courses in Canada. No Canadian credit history required.

What is a microloan?

A microloan is a loan of a smaller amount offered to individuals without or with limited Canadian credit history. A microloan from Windmill Microlending, of up to $15,000 (Canadian dollars), can be used to pay for things like tuition fees, qualifying exam costs, text books, professional association fees, costs associated with licensing or accreditation, supplies and living expenses while you study.

How to find out if you are eligible for a Windmill microloan

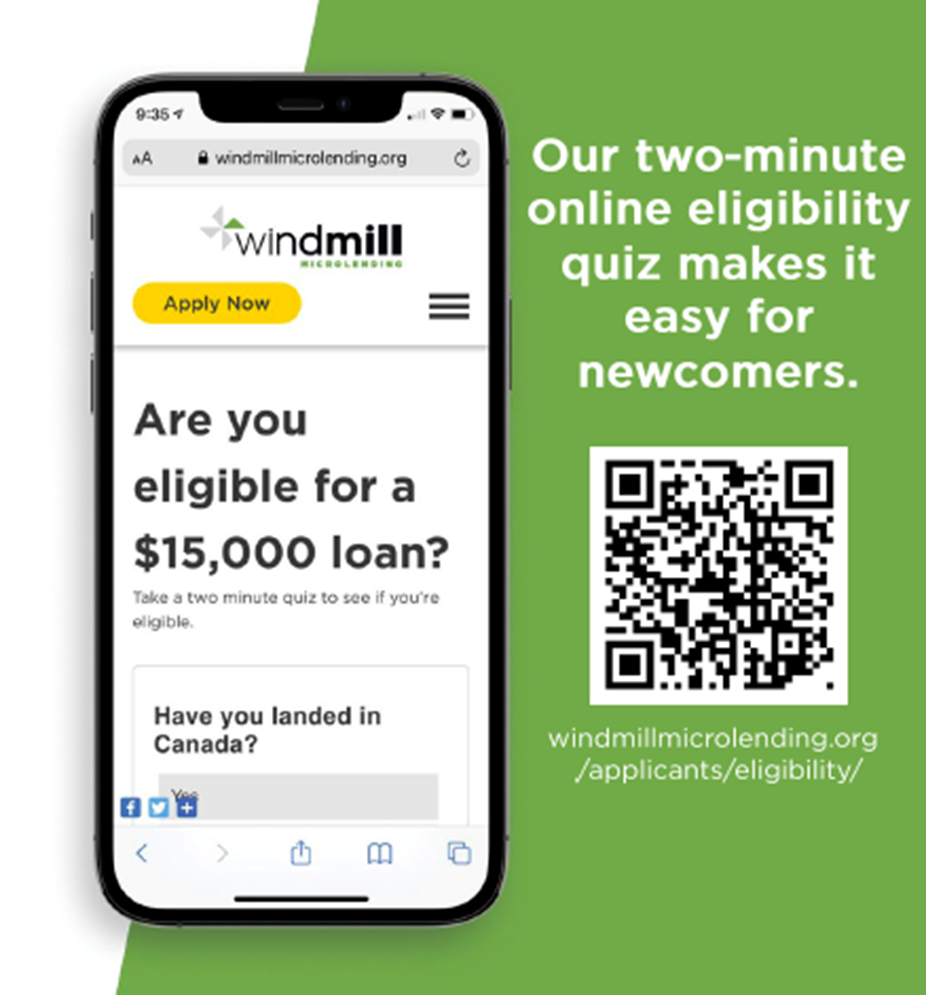

Complete Windmill’s two-minute online eligibility quiz, found here:

Who is eligible for a Windmill microloan?

To be eligible for a Windmill loan, you must be an immigrant and an internationally-trained individual living in Canada on a permanent status. Internationally-trained individuals must have completed post-secondary education outside of Canada and/or have a minimum of one year of post-secondary work experience before coming to Canada.

A Windmill microloan up to $15,000 may be used for:

- Education and training programs of two years or less

- Fees for licensing and qualifying exams

- Living allowance during a period of study

- Courses to help you further your career

- Relocation costs for employment

- Travel expenses to take courses or exams not available in your area

- Books, supplies and course materials

- Professional association fees

To be eligible for a Windmill loan, you must:

- Be internationally trained or have a minimum of one year of post-secondary work experience before coming to Canada.

- You must also be living in Canada as a Permanent Resident, Provincial Nominee, Canadian Citizen, Protected Person or Convention Refugee.

Windmill Microlending has provided over 8000 microloans totalling $67 million+ since 2005 Whether you intend to work in the same field you trained in outside of Canada, or you wish to apply your transferable skills to a new career, you must demonstrate that you have a Career Success Plan that requires funding. You must not have an undischarged bankruptcy or a consumer proposal that has been active for less than 6 months. You can check your eligibility by doing our two-minute eligibility quiz.