CRA allows all employees, who worked from home because of COVID-19 in 2020, to claim up to $400 in employment expenses as a flat rate. This amount is a tax deduction and not a credit, which means you deduct it from your income to reduce your tax liability but will not result in a refund.

Temporary flat rate method

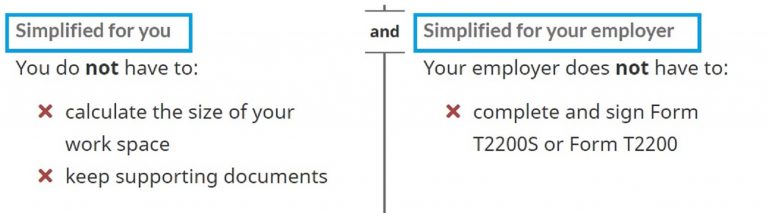

- This method simplifies your claim for home office expenses (work-space-in-the-home expenses and office supply and phone expenses).

- If you worked more than 50% of the time from home for a period of at least four consecutive weeks in 2020 due to the COVID-19 pandemic, you can claim $2 for each day you worked from home during that period.

- You can then also claim any additional days you worked at home in 2020 due to the COVID-19 pandemic.

- The maximum amount that can be claimed is $400 per individual. This method can only be used for the 2020 tax year.

- Claim the amount on line 22900 of your tax return.