Small business deduction

A Canadian-controlled private corporation (CCPC) currently benefits from a reduced corporate tax rate on its first $500,000 of active business income (for example, the “business limit”). This is commonly referred to as the “small business tax rate” and it produces a combined federal/provincial tax rate of approximately 12% in most provinces. Active business income above this business limit is generally taxed at a higher combined rate of approximately 26% in most provinces.

Under current tax legislation the $500,000 business limit is reduced on a straight-line basis when:

1. The combined taxable capital employed in Canada of the CCPC and its associated corporations is between $10 million and $15 million; or

2. The combined “adjusted aggregate investment income” of the CCPC and its associated corporations is between $50,000 and $150,000.

In particular, the business limit is calculated as the lesser of the two amounts determined by these business limit reductions.

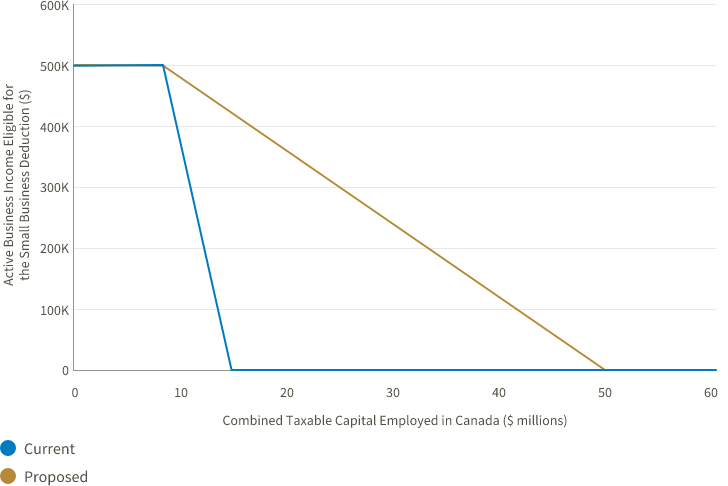

The budget proposes to phase out access to the small business tax rate more gradually under part one of the above formula. Namely, it proposes that the small business limit be fully phased out when taxable capital reaches $50 million, rather than at $15 million. As such, the new range would be $10 million to $50 million of taxable capital. This measure would apply to taxation years that begin on or after April 7, 2022. Note that the proposal only applies to the federal portion of the small business tax rate, but it’s expected that the provinces will follow this measure.

This change would allow more medium-sized CCPCs to benefit from the small business deduction. For example, under the new rules a CCPC with $30 million in taxable capital would have up to $250,000 of active business income eligible for the small business deduction, compared to $0 under current rules (assuming no adjustment for adjusted aggregate investment income above $50,000).

The following chart illustrates the current and proposed reductions to the small business limit based on taxable capital.

Source: Budget 2022 Tax Measures: Supplementary Information

Non-CCPC planning

The Department of Finance (Finance) is concerned that taxpayers are setting up investment holding companies in a way that avoids the refundable tax mechanism that typically applies to investment income earned by a corporation. As background, investment income earned by a CCPC is subject to a high rate of tax compared to active business income so that individuals aren’t incentivized to hold their investments through a corporation. Most of the taxes paid by a CCPC on its investment income are refundable to the corporation when it pays a taxable dividend. Using Ontario tax rates, for example, in the case of interest income the tax rate is 50.17% and the refundable portion is 30.67%. Without getting into the intricacies of corporate taxation, the refundable portion of these taxes generally creates an anti-deferral mechanism so that there are no significant tax advantages of earning investment income through a CCPC.

Tax professionals have developed planning whereby their clients use investment holding companies that don’t qualify as a CCPC to avoid the refundable tax anti-deferral mechanism. For example, one planning method used to avoid CCPC status is to continue a Canadian incorporated company under a foreign jurisdiction while maintaining the company’s Canadian residency by keeping its central management and control in Canada. The advantage of doing so results in investment income subject to tax at lower rates. Using the Ontario example above, the interest earned in a non-CCPC corporation would be subject to tax at a rate of 26.5%. This type of planning is known as non-CCPC planning.

The budget proposes to amend the Income Tax Act (Canada) (ITA) to align the taxation of investment income earned and distributed by “substantive CCPCs” (for example, a non-CCPC) with the rules that currently apply to CCPCs. According to the budget documents, “substantive CCPCs would be private corporations resident in Canada (other than CCPCs) that are ultimately controlled (in law or in fact) by Canadian-resident individuals.” This measure is ultimately designed so that substantive CCPCs are taxed in the same manner as CCPCs. It appears non-CCPCs would still be able to benefit from the capital dividend account mechanism. This measure would apply to taxation years that end on or after April 7, 2022.

Intergenerational transfers – the story continues

Bill C-208 received royal assent on June 29, 2021. The bill amended the ITA to allow a business owner to sell or transfer their shares in a qualified small business corporation or family farm and fishing corporation to a corporation owned by their adult child or grandchild without adverse tax consequences that previously applied. In particular, the amendments contained in Bill C-208 enabled the sale proceeds to be taxed at capital gains rates instead of at higher dividend rates.

On July 19, 2021, Finance confirmed that it intended to bring forward draft legislative amendments for consultation. The amendments would be intended to ensure that the provisions of the ITA facilitate genuine intergenerational transfers and are not used for surplus stripping purposes without a genuine transfer of a business taking place. To date, no proposed amendments have been released by Finance.

The budget proposes a consultation period ending June 17, 2022, in which stakeholders can provide their views on how the existing rules could be “strengthened to protect the integrity of the tax system while continuing to facilitate genuine intergenerational business transfers.” Amended legislation would then follow and may be included in a bill to be tabled in fall 2022.

Strengthening the general anti-avoidance rule

The general anti-avoidance rule (GAAR) in the ITA is intended to prevent taxpayers from structuring a transaction in an abusive manner to achieve a reduction in taxes. The courts have generally held that GAAR doesn’t apply to a transaction that results in an increase in an asset’s tax attributes, but has not otherwise been used to reduce taxes.

To address this, the budget proposes to amend the ITA so that GAAR can apply to transactions that affect an asset’s tax attributes regardless of whether they have yet been used to reduce taxes. Furthermore, following up on comments made in the 2021 federal budget regarding its intention to modernize GAAR, Finance also announced it intends to release a consultation paper and provide a consultation period on this matter. Draft legislation would then follow by end of 2022.

Investment Tax Credit for Carbon Capture, Utilization, and Storage

The Budget proposes a refundable investment tax credit for businesses that incur eligible carbon capture, utilization, and storage (CCUS) expenses, starting in 2022. The credit would be available to CCUS projects to the extent that they permanently store captured CO2, through an eligible use.

From 2022 through 2030, the investment tax credit rates would be as follows:

• 60 percent for investment in eligible equipment to capture CO2 in direct air capture projects;

• 50 percent for investment in eligible equipment to capture CO2 in all other CCUS projects; and

• 37.5 percent for investment in eligible equipment for transportation, storage and use.

These rates will be reduced by 50 percent for the period from 2031 through 2040.

Tax measures affecting financial institutions

• According to the budget documents, the pandemic resulted in the federal government spending more than $350 billion for health and safety and direct support measures. As a means of recovering a portion of these expenditures, the budget proposes that certain banks and life insurance companies pitch in more under the following measures:

• A temporary Canada Recovery Dividend, under which banking and life insurers’ groups (as determined under Part VI of the ITA) pay a one-time 15% tax payable over five years on taxable income above $1 billion for the 2021 tax year.

• A permanent increase in the corporate income tax rate by 1.5% on the taxable income of banking and life insurance groups (as determined under Part VI of the ITA) above $100 million, such that the overall federal corporate income tax rate above this threshold will increase from 15% to 16.5%.

Tax Credit for Investments in Clean Technology

• The Government proposes an investment tax credit of up to 30 percent focused on net-zero technologies, battery storage solutions, and clean hydrogen. The design details of the investment tax credit will be provided in the 2022 fall economic and fiscal update.

Support for Business Investment in Air-Source Heat Pumps

• The Budget proposes to expand the accelerated tax deductions for business investments in clean energy equipment to include air-source heat pumps. This measure would apply in respect of property acquired and available for use on or after Budget Day.

• In addition, the Government proposes to extend the 50-percent reduction of the general corporate and small business income tax rates for zero-emission technology manufacturers to include manufacturers of air-source heat pumps. The reduced rates would apply to taxation years that begin after 2021 and phased out from 2029 to 2031.

Critical Mineral Exploration Tax Credit

A new 30-percent Critical Mineral Exploration Tax Credit is proposed for specified mineral exploration expenses incurred in Canada and renounced to flow-through share investors as part of an agreement entered into after Budget Day and on or before March 31, 2027.

Phasing Out Flow-Through Shares for Oil, Gas, and Coal Activities

Budget 2022 proposes to eliminate the flow-through share regime for fossil fuel sector activities by no longer allowing related exploration or development expenses to be renounced to flow-through share investors. This change would apply to flow-through share agreements entered into after March 31, 2023.

Engaging with the Cannabis Sector

The Government announced it intention to engage with all stakeholders in the cannabis sector, to identify ways to grow the legal cannabis sector in Canada.

To learn more about Corporate Taxes, browse our course and Download Syllabus

https://www.fintechcollege.ca/income-tax-t2/

This material is for information purposes only and should not be construed as providing legal or tax advice. Reasonable efforts have been made to ensure its accuracy, but errors and omissions are possible.