What are Tax Credits?

Tax credits are amounts that reduce the tax you pay on your taxable income. The more tax credits that apply to you, the more you can reduce your income tax. The federal, provincial and territorial governments each provide tax credits, which you can use to lower your taxes.

What are Non-Refundable Tax Credits?

- Non-refundable tax credits are designed to reduce your federal tax payable but they don’t create a tax refund.

- The key difference between a non-refundable and a refundable tax credit is that in the event your total non-refundable tax credits equals more than the amount of tax you owe, your amount owing will only be reduced to zero; this means that the excess amount of credit will not be refunded to you.

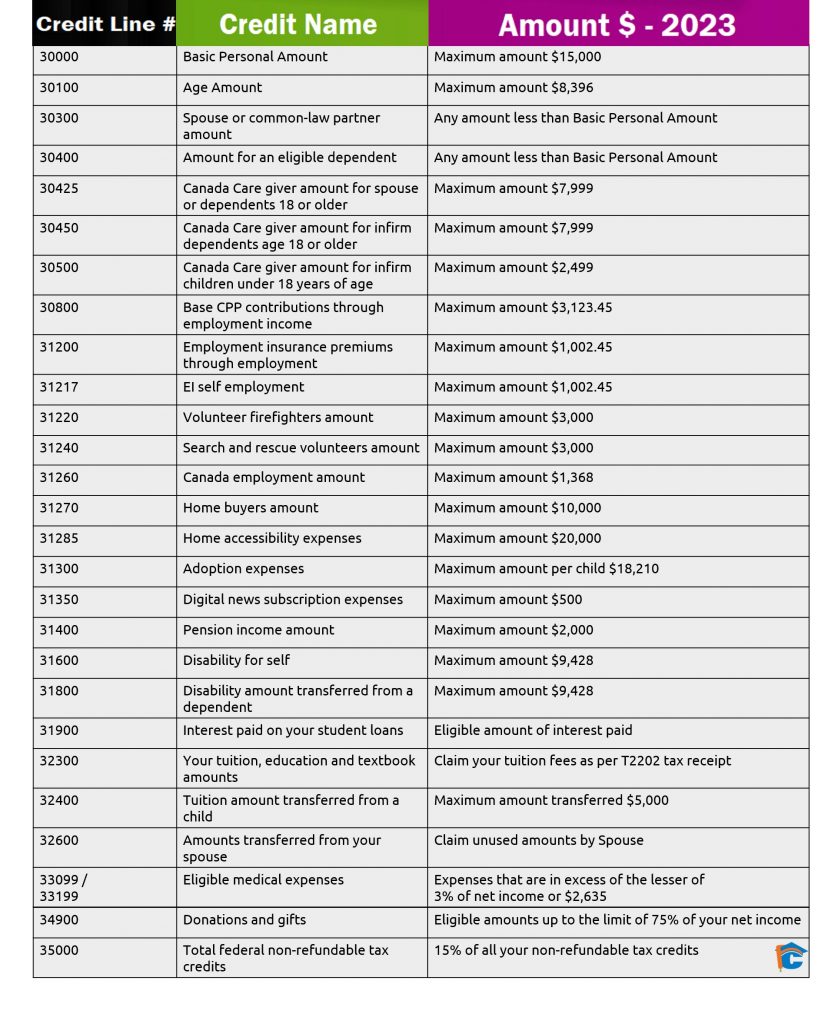

- Examples of Non-Refundable Tax Credits: Basic Personal Amount, Age Credit, Donation Tax Credit, Tuition, Education and Textbook Amount, Eligible Dependent Tax Credit.

Here’s a list of all the non-refundable tax credits with claimable amounts for the year 2023 for April 30th 2024 tax filing.

Make Your Career with our Taxation Career Pathway