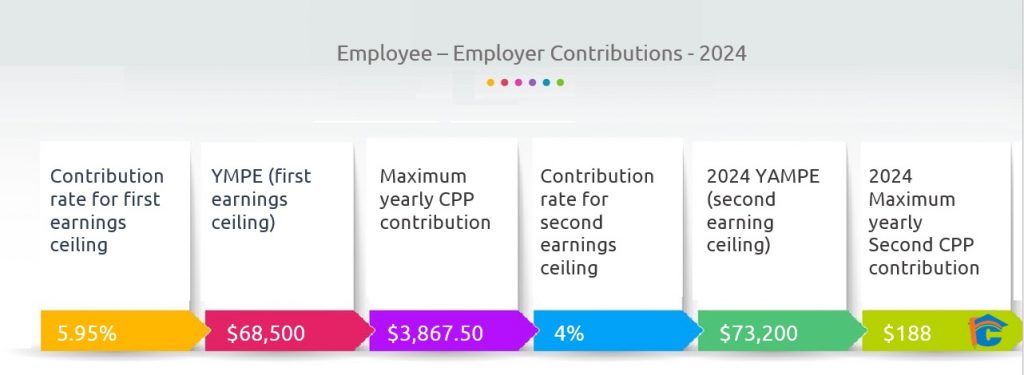

For 2024, employee and employer CPP contribution rates will remain at 5.95 per cent, but the maximum pensionable earnings will increase to $68,500, while the basic exemption amount remains at $3,500. This increase was calculated in accordance with CPP legislation, and takes into account the growth in average weekly wages and salaries in Canada.

This means the 2024 maximum CPP contribution will be $3,867.50 for each of the employee and employer portions. The self-employed CPP contribution rate remains at 11.9 per cent, and the maximum contribution will increase to $7,735.

- Starting Jan. 1, 2024, however, a second CPP contribution rate and earnings ceiling is being introduced that will be called the “year’s additional maximum pensionable earnings” (YAMPE). It will only affect workers whose income is above the first earnings ceiling.

- The level of the second earnings ceiling is based on the value of the first earnings ceiling. For 2024, the second earnings ceiling was set at an amount that is seven per cent higher than the first earnings ceiling, and for 2025, the second earnings ceiling will be set at an amount that’s 14 per cent higher than the first earnings ceiling.

- As a result, for 2024, pensionable earnings between $68,500 and $73,200 will be subject to “second CPP contributions” (CPP2) at an employee/employer rate of four per cent, with a maximum contribution of $188 each. The 2024 self-employed CPP2 contribution rate will be eight per cent, and the maximum self-employed contribution will be $376.

Source: CRA Canada

Where will the CPP amounts be reported on T4?

- The base and first enhanced CPP or QPP contributions are to be reported in Box 16.

- The second CPP contributions are to be reported in Box 16A.

Contributors are not required or permitted to make contributions on pensionable earnings above $73,200.

Let’s take an example.

Johnson has an annual income of $100,000, which is higher than the second earnings ceiling. He will make base and first CPP contributions at a rate of 5.95 per cent and, beginning in 2024, second CPP contributions at a rate of four per cent on the difference between the annual YAMPE and the YMPE.

For 2023, Johnson contributed $3,754 of CPP contributions, being 5.95 per cent of the 2023 YMPE of $66,600, less the $3,500 base amount. For 2024, given the new YMPE of up to $68,500, which is the first earnings ceiling, he will contribute $3,867.50 of base CPP. Given the second earnings ceiling for 2024 of $73,200, Johnson will contribute the full $188 in second-level CPP for total 2024 CPP contributions of $4,055.

The good news is that all employees can claim a 15 per cent federal non-refundable credit on base CPP contributions, which are calculated at a rate of 4.95 per cent, and a tax deduction for both first CPP contributions (one per cent) and the upcoming second CPP contributions.

Self-employed Canadians who contribute 9.9 per cent to CPP can claim a 15 per cent non-refundable federal tax credit on 4.95 per cent of the base CPP contributions, and a tax deduction for the other 4.95 per cent. They can also claim a tax deduction on the enhanced portion of their contributions (two per cent in 2023).

For incorporated self-employed business owners, including professionals such as doctors, lawyer and accountants who operate through professional corporations, the increased cost of CPP contributions in 2024 (just over $8,100 for income of $73,200 or more) must be considered when the compensation decision to pay yourself salary or dividends (which are not subject to CPP contributions) is made for next year.

Fintech College is here to support your journey to becoming a tax expert. Our comprehensive tax courses and programs are designed to provide you with the knowledge and skills necessary to excel in the world of taxation. Whether you’re just starting or looking to enhance your expertise, we’re here to help you unlock your potential and achieve your goals as a tax expert.

Make Your Career with our Taxation Career Pathway