Income Tax Brackets – T1(Personal) – 2022

Canada’s inflation surged 4.7% in October, its largest gain in 18 years. The primary cause of inflation was sky-high energy and house prices. To tackle inflation, the Canada Revenue Agency (CRA) increases the 2022 tax breaks after adjusting for inflation, which is called indexation. In the light of high inflation, the CRA increased its indexation rate to 2.4% for 2022 from 1% last year. This increased indexation will bring a big change to your tax bill in the 2022 tax year.

Tax break changes in 2022

Basic personal amount

The CRA increased the basic personal amount by $590 to $14,398 for 2022. In case your taxable income is less than $155,625, you will be eligible to save $2,160, which is 15% of $14,398.

Minimum taxable amount

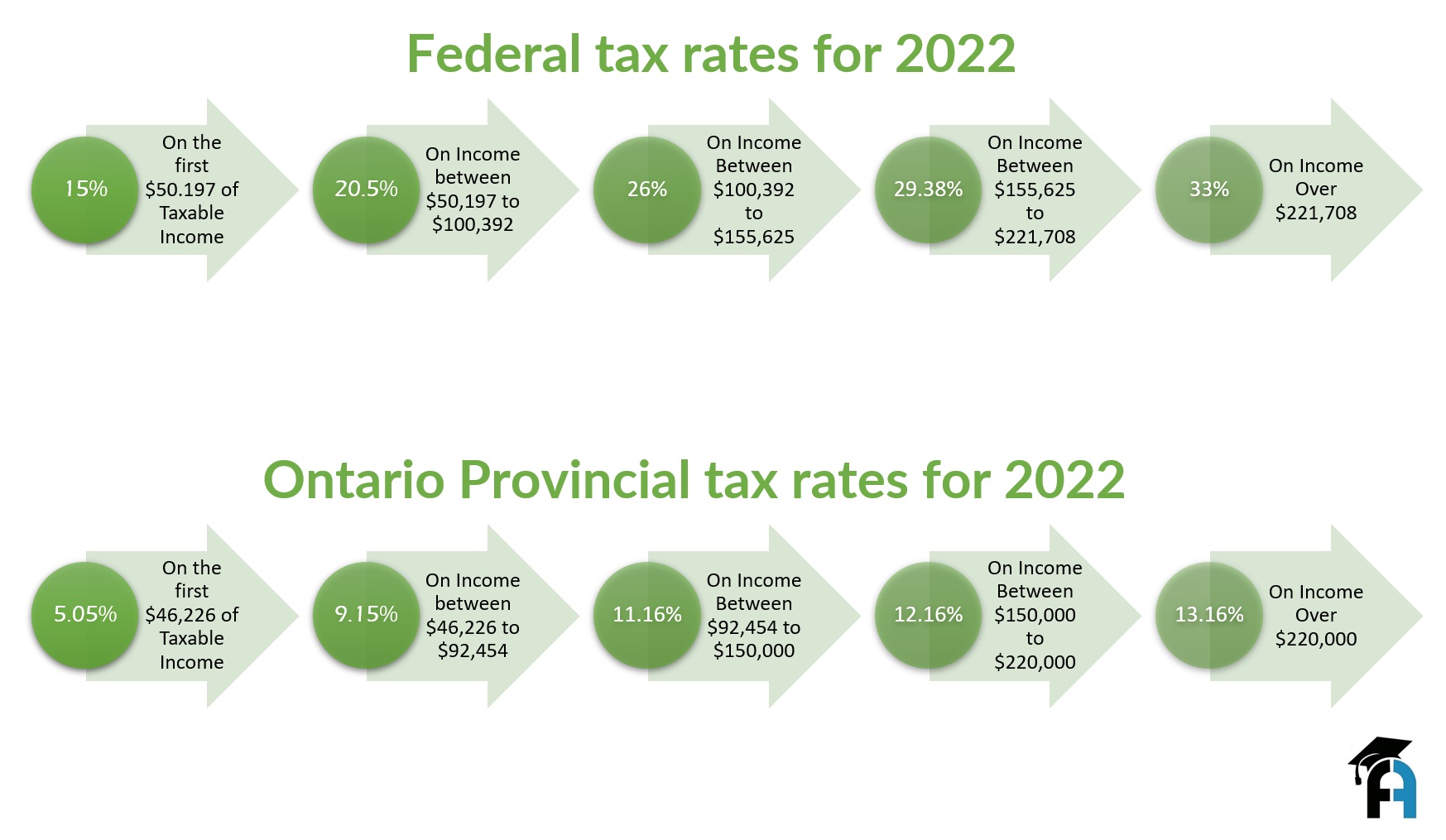

The CRA has increased the minimum taxable amount to $50,197, up from $49,020. So, in case your taxable amount is below the threshold, a federal tax rate of 15% will be applicable.

Age amount

The CRA also offers a tax credit for seniors over the age of 65. The age amount has been increased to $7,898, allowing you to reduce the tax bill by $1,185, which is 15% of the age amount.

If an individual’s taxable income is $50,197, the above three tax breaks would reduce her federal tax bill by $302. There are many more tax credits that can use to reduce tax bill.

To learn more enroll in our Income Tax T1 course