What is T4A? What is T5018?

T4A and T5018 forms are used to record payments made to subcontractors during either the previous fiscal or calendar year.

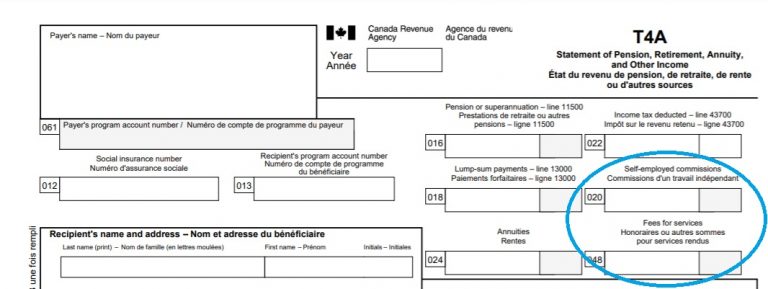

What is T4A?

- The T4A form (PDF download) is a record of what you paid to a subcontractor during the previous calendar year.

- T4A forms must be filed with Canada Revenue Agency (CRA) on or before the last day of February after the applicable calendar year.

- You’ll also need to provide copies of the T4A to your suppliers.

- Examples are fees paid to your freelance bookkeeper, accountant and lawyer or janitor. Service fees for tutors or examiners for educational institutions would also be reported here.

- T4A – Box 020 or Box 048

Box 20 – Self Employed Commissions or Box 48 – Fees for Services

- If you receive a T4A with Box 20 or Box 48 amounts, you are indeed self-employed for tax purposes as both of these boxes are used exclusively to report self-employment income. You’re either a contractor or you’ve earned income from commission-based activities.

- Having a T4A with Box 20 or 48 means that you’re required to complete a bit of extra info at tax time. Since you’re self-employed, you’ll complete the business form T2125 – Statement of Business Activities.

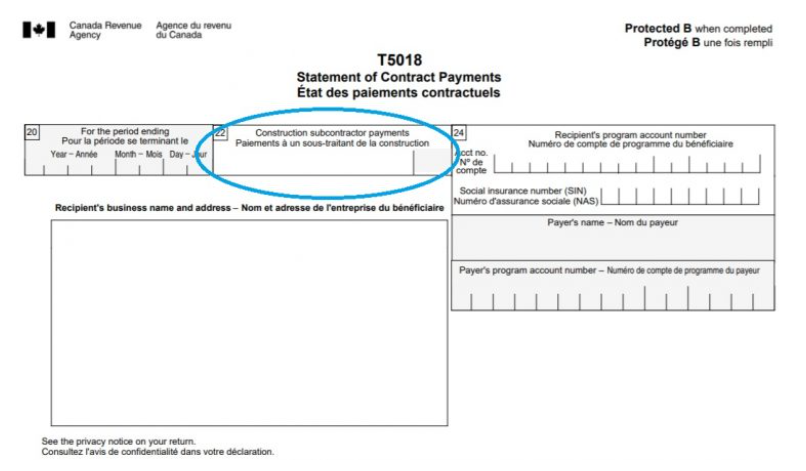

What is T5018?

- The T5018 form (PDF download) is a record of what you paid a subcontractor for construction services during the previous calendar or fiscal year.

- It is a Taxable Income. Payments of less than $500 per year per subcontractor do not have to be reported.

- The T5018s and T5018 Summary must be filed with the CRA on or before the date that is six months after the end of your calendar or fiscal year.

- The payer is not required to, but may provide you with a copy of the T5018 to each subcontractor. The payer must give the Canada Revenue Agency (CRA) a copy.

- As a subcontractor, it’s your responsibility to report all money received on your tax return (normally on Schedule T2125 for non-incorporated subcontractors).

- Examples include the erection, excavation, installation, alteration, modification, repair, improvement, demolition, destruction, dismantling or removal of all, or any part, of a building, structure, surface or sub-surface construction, or any similar property if the person’s business income for that reporting period is derived primarily from those activities.

Box 22 – Construction subcontractor payments

- Box 22 of the T5018 shows the total amount of payments made by a contractor in their selected reporting period.

- For unincorporated entities, the income should be reported on Form T2125, Statement of Business or Professional Activities, as revenue on line 4A.

To learn more enroll in our Income Tax T1 course

well done to you for sharing such an informative post. You have definitely done your research and it’s evident. Keep up the great work!