What is Ontario’s Employer Health Tax?

The EHT is a payroll tax paid by employers based on their total annual remuneration. EHT contributions made by an employer are determined by the rate attributed to their remuneration. For those businesses that pay remuneration to employees that report to work in Ontario or are paid through a business with a permanent establishment in Ontario, EHT must be calculated and remitted to the Ontario Ministry of Finance. The employer bears 100% of the burden of this tax payment.

How is EHT calculated?

The amount of EHT payable is calculated by multiplying the employer’s taxable Ontario remuneration for the year by the applicable tax rate

Total Ontario remuneration for an employer means payroll for:

- employees who report for work at the employer’s permanent establishment in Ontario, and

- employees who do not report for work at any permanent establishment but who are paid from or through the employer’s permanent establishment in Ontario.

Remuneration includes all employment income payments, benefits and allowances which are taxable under sections 5, 6, or 7 of the Income Tax Act (Canada), or would be required to be included if the employee were a resident of Canada.

Examples of payroll include salaries and wages, gratuities paid through an employer, bonuses, commission and other similar payments, vacation pay, taxable allowances and benefits, directors’ fees, payments for casual labour, amounts paid by an employer to top up benefits and advances of salaries and wages.

Taxable Ontario remuneration is the amount of taxable Ontario remuneration minus the employer’s allowable exemption amount.

Tax rates

Example

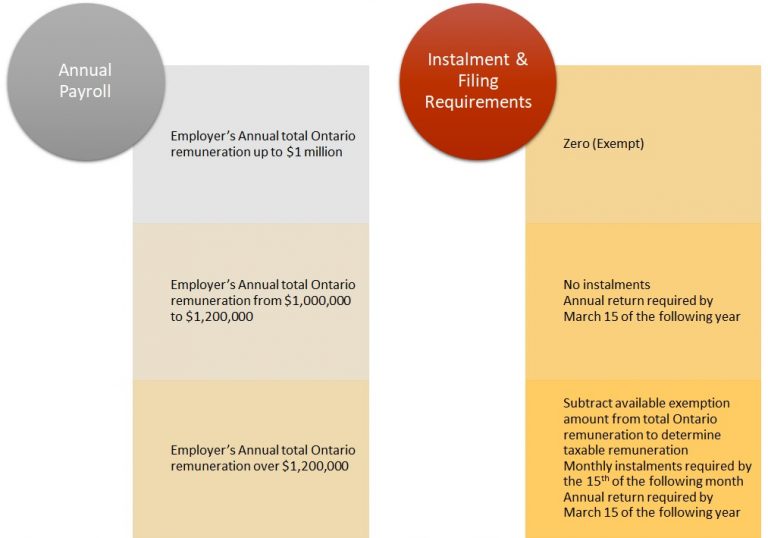

Filing Requirements and Instalments

Ontario EHT annual exemption

In response to COVID-19, in 2020 the annual exemption was increased from $490,000 to $1 million. The $1 million exemption was maintained into 2021 and is set to continue in place until 2028. There is no exemption for eligible employers and groups of associated employers with annual Ontario payroll over $5 million

Note: If your payroll includes employees in the province of Ontario, SUBMIT your Annual EHT Return by March 15 (deadline).

Further details here

To learn more, enroll in our Essentials Payroll Administrator course