Bookkeeping vs. Accounting: An Overview

Bookkeeping is the process of recording all financial transactions made by a business. Bookkeepers are responsible for recording, classifying, and organizing every financial transaction that is made through the course of business operations. Bookkeeping differs from accounting.

The accounting process uses the books kept by the bookkeeper to prepare the end of the year accounting statements and accounts.

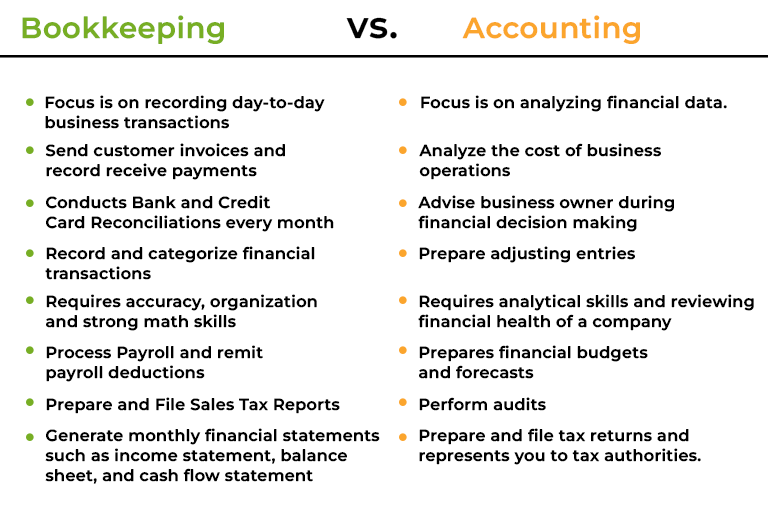

Here’s a quick synopsis of what a Bookkeeper does and what an Accountant

Bookkeeper’s Education

Bookkeeper responsibilities include recording financial transactions, overseeing an organization’s general ledger, and creating financial reports. Most employers prefer candidates who complete college courses in accounting or a related field. Most employers rely on software programs to complete tasks. Knowledge of Specialized programs that manage business finances, perform payroll services, and generate invoices are mandatory for bookkeepers to work efficiently.

Accountant’s Education

Chartered accountants require a university degree and Completion of a professional training program approved by a provincial institute of chartered accountants and, depending on the province, either two years or 30 months of on-the-job training and Membership in a provincial Institute of Chartered Accountants upon successful completion of the Uniform Evaluation (UFE). You can find details here.

Skills for Accountant’s and Bookkeeper

Attention to detail

Attention to detail and accuracy are vital when dealing with numbers, costs, and financial data. A bookkeeper must have a critical eye to ensure general ledger coding is correct and that bank reconciliations are accurate to the penny. An accountant must notice small changes or patterns in financial records that can impact the financial health of an organization over the long term.

Communication

Effective communication is critical to success in both positions, specifically written communication. A bookkeeper must have a firm grasp of the English or French language to understand invoices, accounting records, and other financial documentation. An accountant must be equally proficient in written communication, as they are often involved in financial reports and presentations to company stakeholders. Clear communication provides clear financial information.

Computer literacy

Most companies and organizations use computerized accounting practices, whether on a Microsoft Excel spreadsheet or a third-part accounting software program. A bookkeeper must be comfortable using computer systems to record financial transactions. And an accountant uses these programs to look at the information to provide analysis and advice. Being competent in basic computer literacy is vital to the success of both professions.

Mathematics

The fundamentals of accounting and bookkeeping are mathematics. Being able to add, subtract, multiply, and divide are cornerstones to accounting transactions. Both professions must be competent in basic math and perform more advanced calculations when handling investments, taxes, or other more complex transactions.

Organization

Both a bookkeeper and an accountant require a high level of organization in their professional life. Managing receipts, transactions, records, and statements requires knowing where the information is and how to locate it quickly and efficiently. Organizational skills also support effective time management and the ability to prioritize.

Problem-solving

Problem-solving is a practical and valuable skill for both professions. A bookkeeper needs to use problem-solving skills to fix journal entry discrepancies, find missing data to complete a bank reconciliation, and handle late invoices or accounts receivable payments. An accountant uses problem-solving skills when analyzing financial data to forecast an expansion, determine the best tax savings for a business, or develop cost-savings measures.

Integrity:

Integrity is critical to this profession as accountants and bookkeepers must maintain transparent records and confidentiality.

Roles and Responsibilities of Bookkeeper

Bookkeeping is a crucial first step in the accounting process. They lay the foundation for accountants by recording financial transactions. Depending on the company, industry, and position, the duties of a bookkeeper will differ slightly. Still, they will strongly emphasize financial administrative and clerical tasks, such as organizing receipts and data entry. Below is a concise description of the primary duties most bookkeepers perform:

- Bookkeepers record financial transactions, including income from products or services and expenses such as rent, utilities, and office supplies.

- A bookkeeper may create and send invoices to customers and make payments to vendors on your behalf, depending on your arrangement.

- Organizing purchase receipts and invoices and managing both accounts payable and receivable

- Processing reimbursement requests and expense reports

- Calculating basic tax deductions and preparing for GST filing and submittal

- Managing payroll account and processing payroll for employees, including income tax, CPP, and EI deductions

- Ensuring all financial records meet provincial and federal documentation requirements

- Producing regular financial reports, such as an income statement, balance sheet, and cash flow statement

- Managing bank account reconciliations every month

Roles and Responsibilities of Accountant

Because much of the data entry of the financial transactions are completed by a bookkeeper, it allows an accountant to spend most of their time on high-level analysis, financial reporting, and providing advice and guidance.

An accountant can perform dozens of services, but here are some core tasks that an accountant performs:

- Producing regular financial reports, to help you see the bigger picture and assess the financial health of your business, including:

- Balance sheets: A snapshot of your financial situation at a point in time, calculated through this formula: Assets = Equity – Liabilities

- Income statements: A record of all your income and expenses over a period of time

- Cash flow statement: A record of cash flowing in and out of your company for a period of time

- Analyzing journals and ledger entries and making adjustments, e.g., accountants will identify any incurred expenses not yet recorded

- Providing tax preparation services and providing tax advice

- Assisting with financial budgets, tax planning, and financial management advice

- Forecasting the outcome and impact of financial decisions, such as expansions, capital asset purchases, or investments

- Filing year-end provincial and federal tax returns and supporting any audit requests

What does a Bookkeeper Charge?

The salary or rates you’ll pay a bookkeeper depend on your business and its bookkeeping needs. Three main factors affect your costs: the services you want, the expertise you need, and your local market.

Services:

The bookkeeping services your business needs and the amount of time it takes weekly or monthly to complete them affect how much it costs to hire a bookkeeper. If you need someone to come to the office once a month to reconcile the books, it will cost less than if you need to hire someone full-time to handle your day-to-day operations. Once you know what tasks you need the bookkeeper to do, estimate how long it will take to complete those tasks. Based on that calculation, decide if you need to hire someone full-time, part-time or on a project basis.

Expertise:

If you have complex books or are bringing in a lot of sales, hire a certified or licensed bookkeeper. An experienced bookkeeper can give you peace of mind and confidence that your finances are in good hands, but they will also cost you more.

Local market:

Your business’s location can also influence how much you pay for a bookkeeper. According to the Job Bank Canada statistics (NOC1311), the national average salary for bookkeepers in 2022 was between $16.00/hour and $38.69/hour or $33,280 to $80,475.

What does an Accountant Charge?

According to the Job Bank Canada Statistics (NOC1111), the median salary for an accountant in 2022 was between $21.63/hour and $60.00/hour in Canada or $44,990 to $124,800. However, their years of experience, your state and the complexity of your accounting needs affect the price.

Accountants will either quote a client a fixed price for a specific service or charge a general hourly rate. Basic services could cost as little as $60 an hour, while advanced services could be $150 or more an hour.

Conclusion

A Bookkeeper in a small to medium sized company is expected to wear all the hats i.e., starting from recording financial transactions, paying employees, filing remittances, filing sales tax returns to preparing financial statements.

Nearly all bookkeeping is done using computerized accounting software and programs, so bookkeepers should be familiar with accounting software’s available in industry. Software’s like QuickBooks Desktop, QuickBooks Online, Sage Business, Xero are some of the leading accounting software’s in Canada. Certifications in courses for Online Bookkeeping is also in great demand, due to ongoing pandemic.

At FinTech College, in our Accounting and Bookkeeping Career Pathway you can be a Professional Bookkeeper in less than a year.

Check our link for more details https://www.fintechcollege.ca/toronto/