What are the Types of Accounting Methods?

There are two methods of accounting: cash-based and accrual-based.

These two methods will dictate how income is recognized based on the timing of transactional records in accounts.

The method you use for your accounting influences your business in many ways:

-

- Revenue is recognized differently in each method. You need to be sure that the method you choose suits the way you want to calculate revenue for your company.

- Both methods offer different financial reports that affect the way you determine the financial position of your company, and make business decisions for the future. You need to choose the method that offers the right financial reports for your business.

- The method you choose influences how you file taxes and claim tax deductions. This is because the cash and accrual methods report taxes at different periods depending on when revenue is earned. You need to choose the method that works best for you during tax season.

How to Use the Accrual Method of Accounting

Accrual accounting is the method that records a company’s transactions when the original transaction takes place. Therefore, accrual revolves around the event of a transaction, rather than the actual transfer of funds.

With this system, you record revenue when you earn it, and expenses when you incur them, irrespective of when the payment is made.

Example:

Let’s say you sell portable fans to your customers.

You did a sale of $1000 on 1st December. You haven’t received the funds for the same but you still are going to record this sale in your books as your income. This is accrual method, where the sale is done on credit.

In accrual method, your books will show Accounts Receivables and Accounts Payables.

Benefits of Accrual Accounting

- You have a much more accurate picture of business performance and finances

- You can make financial decisions with far more confidence

- It can sometimes be easier to pitch for long-term finance

Downsides of Accrual Accounting

- It’s more work because you have to watch invoices, not just your bank account

- You may have to pay tax on income before the customer has actually paid you –if the customer reneges on the invoice, you can claim the tax back on your next return

What is Cash-Basis Accounting?

As the name suggests, the underlying factor in cash based accounting is cash itself. It is the simpler of the two methods. Here, transactions are recorded whenever you receive cash payments from customers, or whenever cash leaves your company in the form of expenses or vendor payments.

Example:

Let’s take the same example as before, say you sell portable fans to your customers.

You did a sell of $1000 on 1st December. You received the money of December 5th. In cash accounting, you record the sales transactions as an income in your books on December 5th.

Benefits of Cash Accounting

Cash accounting is simple offers many advantages to very small businesses that operate purely on a cash basis.

- It doesn’t require you to have vast accounting knowledge and its simplicity allows you to maintain your accounts without having to hire an accountant.

- It also doesn’t require accounting software, because you can accomplish accounting tasks with a simple cash book, or with spreadsheet software.

- The most important advantage of this method is that it records your transactions purely in terms of cash inflows and outflows. This provides an accurate picture of how much money there is in your company at any given time.

Downsides of Cash Accounting

- It’s not accurate – it could show you as profitable just because you haven’t paid your bills

- It doesn’t help when you’re making management decisions, as you only have a day-to-day view of finances

What is the Best Accounting Method for a Small Business?

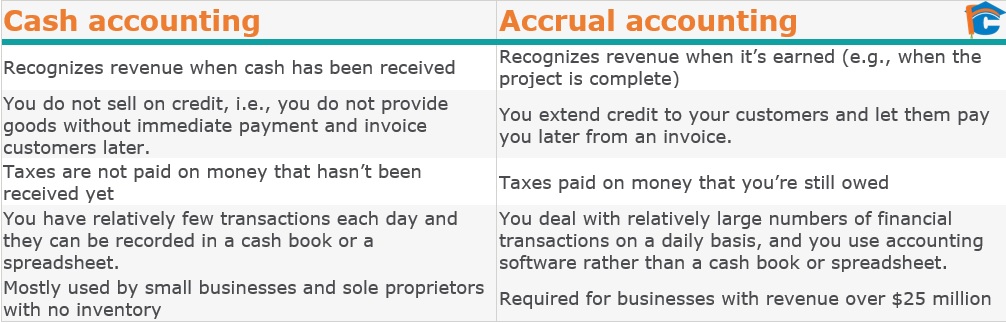

Choosing an accounting method for your business comes down to the type of business you have. Both methods have their benefits. Cash accounting provides a beautiful understanding of your cash flow and is helpful for very small businesses. The accrual method is better for larger businesses and shows the company’s financial position more thoroughly through informative reports. Before you decide on either method for your business, compare the two methods and understand the differences between them so you can find the one that’s the best fit for you.

Changing Your Method of Reporting Income with CRA

If you decide to change your method of reporting income from the accrual method to the cash method, use the cash method when you file your next income tax return.

Make sure you include a statement that shows each adjustment made to your income and expenses because of the difference in methods.

If you decide to change from the cash method to the accrual method:

-

-

- get permission from your tax services office

- ask for this change in writing before the date you have to file your income tax return

- explain why you want to change methods in your letter

-

CRA Guidance on how to change methods here.

To learn more about Bookkeeping, browse our course and Download Syllabus