If you receive federal benefits, including some provincial/territorial benefits, you will receive payment on these dates. If you set up direct deposit, payments will be deposited in your account on these dates.

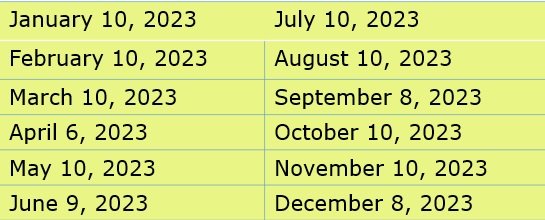

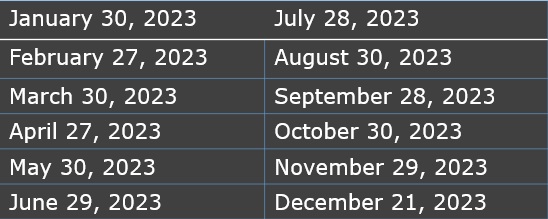

1. Canada Pension Plan

Includes the Canada Pension Plan (CPP) retirement pension and disability, children’s and survivor benefits.

Want to learn more about CPP, Click here

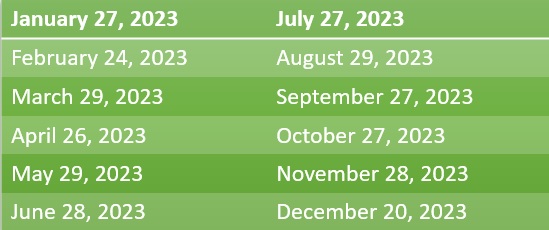

2. Old Age Security

Includes Old Age Security pension, Guaranteed Income Supplement, Allowance and Allowance for the Survivor.

Want to learn more about Old Age Security, Click here

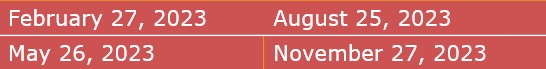

3. GST / HST Credit

Includes related provincial and territorial programs.

Want to learn more about GST/HST Credit, Click here

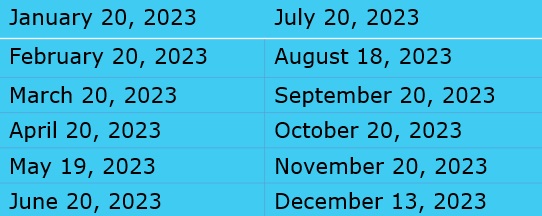

4. Canada Child Benefit (CCB)

Includes related provincial and territorial programs.

Want to learn more about Canada Child Benefit (CCB), Click here

5. Ontario Trillium Benefit (OTB)

Includes Ontario energy and property tax credit (OEPTC), Northern Ontario energy credit (NOEC) and Ontario sales tax credit (OSTC).

Want to learn more about Ontario Trillium Benefit (OTB), Click here

6. Canada Workers Benefit (CWB) – Advance Payment

![]()

Want to learn more about Canada Workers Benefit (CWB), Click here

7. Alberta Child and Family Benefit (ACFB)

Want to learn more about Alberta Child and Family Benefit (ACFB), Click here

8. Veteran Disability Pension

Want to learn more about Veteran Disability Pension, Click here

9. Climate Action Incentive Payment

Basic amount and rural supplement for residents of Alberta, Saskatchewan, Manitoba and Ontario.

Want to learn more about Climate Action Incentive Payment, Click here

To learn more about Taxation, browse our courses and Download Syllabus

https://www.fintechcollege.ca/taxation/