What is the Housing Benefit?

The government announced the one-time $500 federal boost to the existing Canada Housing Benefit program in the fall, pledging to help those eligible cover the cost of rent as it continues to rise nationwide.

The federal government committed to see the top-up rolled out in 2022, with the potential to renew it in the years ahead “if cost of living challenges remain.”

The program is set to cost $1.2 billion, $475 million of which was included in the 2022 federal budget.

Applications are open until Friday, March 31, 2023.

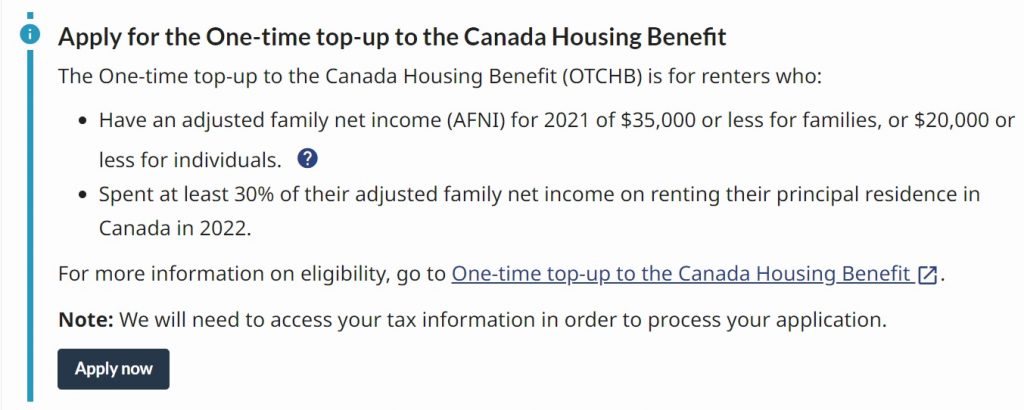

Who is Eligble?

This is a program for low-income renters with adjusted net incomes below $35,000 for families, or $20,000 for individuals who pay at least 30 per cent of their adjusted net income on rent.

Applicants have to be paying rent for their own primary residence in Canada, and need to apply on their own behalf.

And, you must have rented a place where you usually lived sometime in 2022. There are many different rental situations that qualify. For example, you could have rented:

- a rental unit shared with family members or roommates

- a room in a rooming house

- a space in a home owned by a family member

- a college or university dorm room

In order to receive this $500 payment to help cover rent, applicants need to confirm they:

- Have filed their 2021 income tax and benefit return;

- Are at least 15 years of age as of Dec. 1, 2022;

- Are a resident in Canada for tax purposes in 2022;

- Have their principal residence in Canada as of Dec. 1, 2022;

- Have paid rent for their own shelter in 2022; and

- Have paid at least 30 per cent of their 2021 adjusted net family income on rent in the 2022 calendar year.

- be able to provide their 2022 address(es) and landlord’s contact information.

Calculator to Estimate Your Net Family Income

Can Students apply for the Benefit?

Yes, students can apply for the Canada Housing Benefit.

Students must have had an adjusted net income of $20,000 or less for individuals or $35,000 or less for families. Their rent must also be more than 30 per cent of their 2021 income.

Students are considered individuals unless they are married or living common-law, received a Canada Child Benefit for a child under 18 years of age or claimed a deduction on their 2021 tax return for certain family members.

Students must also be at least 15 years old as of Dec. 1, 2022, have Canada as their principal residence, be a Canadian resident for tax purposes and have filed their 2021 tax return.

When applying, individuals must state their principal residence addresses in Canada in 2022, total rent paid in 2022 for these residences and the name and contact of the people to whom the rent was paid.

How can renters apply?

Applicants logging on to their CRA “My Account” or using the direct online form to apply need to be ready to provide some basic information. This includes their address, who they have paid rent to, and how to contact that person.

For those without access to the online systems, the CRA has set up a dedicated line at 1-800-282-8079 with agents that are able to help people complete applications over the phone.

How will I get the benefit?

The CRA will pay the amount by direct deposit. You get the payment about 5 business days after your application has been processed.

If you don’t have direct deposit set up with the CRA, they will send it by cheque. It’s usually mailed out 10 business days after your application is processed.

To learn more about Income TAX, browse our course and Download Syllabus

https://www.fintechcollege.ca/income-tax-t1/

I appreciate the unique perspective you present in your writing.